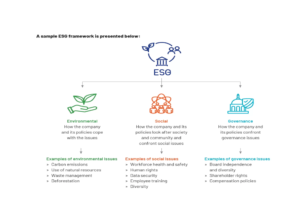

A Pictorial representation of the ESG Framework[6]

Abstract

The term “ESG”—which stands for “environmental, social, and governance”—has evolved, especially in the investing community, to refer to the environmental, social, and governance issues that investors are taking into account when analyzing business behavior and performance and that they may take into account when making investment decisions. This article focuses on what ESG reporting entails, the various indicators, the reporting standards globally and in Ghana and the dangers involved with ESG reporting, focusing mainly on greenwashing.

Introduction

ESG is a general term used in capital markets and by investors to assess corporate behavior and predict future financial performance of organizations.[1] It stands for “environmental, social, and governance” ESG reporting has evolved especially in the investing community, to refer to the environmental, social, and governance issues that investors are taking into account when deciding where and when to invest.

In the middle of the 20th century, interest in sustainability developed as people became more aware of the threat posed by climate change and the human-induced enhanced greenhouse effect, which is primarily caused by the clearance of forests and the combustion of fossil fuels. The 2030 Agenda for Sustainable Development was adopted by the UN General Assembly in September 2015 with the intention of achieving targets in order to reach the 17 Sustainable Development Goals (SDGs).[2]

Sustainability encompasses the efforts made by the companies to mitigate effects of their operations on environments, ecosystems, wildlife, humans, oceans, rivers, landscapes, and the atmosphere. It involves securing the permission to utilize natural resources responsibly while fostering enduring partnerships with stakeholders, including shareholders, employees, contractors, communities, customers, and suppliers.[3]

A company’s primary focus should be on sustainability, which involves strategies and tactics for communicating how the business’s actions influence the environment and society. Sustainable development is defined as “development that satisfies current needs without compromising the ability of future generations to satisfy their own requirements”.[4]

ESG Indicators/ Measures of ESG

Environmental, social and governance measures or standards are used to describe the environmental, social and governance issues that typically influence investors and their decisions to invest in businesses.

The first indicator, environment, refers to the knowledge of factors like population expansion, climate change, and their negative effects on the environment.

Corporate social responsibility (CSR) as we know it, is what encompasses the social indicator of ESG. CSR is included in the category of “Social” activities. It is a response to problems like population increase and climate change as well as the effects of business operations on the communities where they are located.

The third factor is governance. Depending on the situation, different definitions of corporate governance exist. It primarily concerns corporate leadership, namely the function of the board of directors in setting policy and exercising control over an organization. External governance mechanisms are those that have an impact on a corporation but are out of the board of directors’ direct control, such as laws and regulations and the acts of different stakeholders. Internal governance systems are the frameworks and procedures created to guarantee board independence and responsibility through transparent reporting, risk management, and a zero-tolerance policy against bribery and corruption. They cover a board’s organizational structure, committee independence, and methods for reporting to and being held accountable by the board. Executive remuneration and benefits, bribery and corruption, shareholder rights, business ethics, board diversity, board structure, independent directors, risk management, whistleblower programmes, stakeholder communication, lobbying, and disclosure are a few examples of governance challenges. [5]

ESG Reporting Standards

ESG standards are sets of principles for reporting the ESGs of a company or corporation.

These standards and frameworks are necessary for standardized reports. Companies cannot use their own standards to report on their ESGs. However, there is no universal reporting standard or framework for ESG reporting.

Some common ESG reporting standards are:

- The European Financial Reporting Advisory Group (EFRAG) standards. EFRAG was established by the European Commission and is closely tied to that body’s Corporate Sustainability Reporting Directive (CSRD), passed in 2021. The standards focus on sustainability and financial matters.

- The IFRS Sustainability Disclosure Standards, spearheaded by the International Sustainability Standards Board (ISSB). These standards aim to streamline accounting reporting globally, increasing transparency in financial markets.

- The Sustainability Accounting Standards Board (SASB) standards. These focus on all three pillars of ESG and are closely connected with the IFRS standards above.[7]

Ghana, does not have a standard for ESG reporting generally. However, the Ghana Stock Exchange, in their ESG disclosures, guidance manual, August 2022 used the GRI standards of reporting.

The GRI reporting standards are Global best practices for publicly disclosing a variety of economic, environmental, and social impacts are represented by the GRI Standards. Based on the Standards, sustainability reporting reveals whether an organization has made positive or negative contributions to sustainable development.[8]

The report summarized the standards of reporting as follows:

- Accuracy: The organization shall report information that is factually correct and sufficiently detailed to enable the assessment of the organization’s impacts.

- Balance: The organization shall report information in an unbiased way and provide a fair representation of the organization’s negative and positive impacts.

- Clarity: The organization shall present information in a way that is accessible and understandable.

- Comparability: The organization shall select, compile, and report information in a consistent manner, to enable the analysis of changes in the organization’s impacts over time and an analysis of these impacts relative to other organizations.

- Completeness: The organization shall provide sufficient information to enable the assessment of the organization’s impacts during the reporting period.

- Sustainability context: The organization shall report information about its impacts in the wider context of sustainable development.

- Timeliness: The organization shall report information on a regular schedule and make it available in time for information users to make decisions.

- Verifiability: The organization shall gather, record, compile, and analyse information in a way that the information can be examined to establish its quality.[9]

The danger of Greenwashing

To generate an unrealistically optimistic company image, “greenwashing” is the selective presentation of positive information without full disclosure of negative facts.[10] Due to the difficulty for stakeholders in evaluating enterprises’ environmental performance directly, greenwashing is a major empirical phenomenon in the context of organizations’ interactions with the environment. As a result, businesses increasingly rely on environmental reports, advertising, corporate websites, or eco-certification programmes to communicate their environmental quality. Growing skepticism regarding the discrepancy between what businesses say and do on environmental concerns has been fueled by increased environmental disclosure without clear meaningful improvements in environmental consequences.[11]

There is a real risk of companies engaging in greenwashing in their reports to attract investors and to create undue competitive advantage .

Conclusion

Ghana, in its quest to contribute to the SDG goals of sustainability, improve corporate social responsibility and corporate governance, needs to incorporate ESG reporting in its investment standards and also create a regulatory framework for it while taking into account and developing systems that prevent and/or minimize the very apparent risk of greenwashing by companies.

By: Portia Adjei-Mensah Esq.

Nartey Law Firm is a leading corporate and commercial law firm in Ghana providing legal services to individuals, domestic and international businesses. Ensuring the success of our clients’ objectives is at the core of what we do. Comprised of a dedicated team of lawyers with extensive experience in corporate, commercial and international law and litigation, we pride ourselves with the diligent execution of all client matters, whilst guaranteeing an uncompromising standard with respect to excellence in service delivery. Some of our focus areas are Real Estate, Intellectual Property, Energy, Trade and Commerce, Banking and Finance, Regulatory Advisory, Capital Markets and Mergers and Acquisitions.

CONTACT:

NARTEY LAW FIRM

TEL: +233 (0)553508582

Email:info@narteylaw.com

[1] IFAC (2012). Investor Demand for Environmental, Social, and Governance Disclosures: Implications for Professional Accountants in Business. New York, International Federation of Accountants.

[2] Armstrong, A. (2020). Ethics and ESG. Australasian Accounting, Business and Finance Journal, 14(3), 6-17.

[3] BHP Billiton. (2014). Value Through Performance: Sustainability Report 2015.

[4] Bruntland, G. (1987). Our Common Future: The World Commission on Environment and Development. Oxford: Oxford University Press.

[5] Armstrong, A. (2020). Ethics and ESG. Australasian Accounting, Business and Finance Journal, 14(3), 6-17.

[6] https://www.acuitykp.com/market-guide/esg-model-validation/

[7] https://www.thecorporategovernanceinstitute.com/insights/guides/whats-the-difference-between-esg-reporting-standards-and-frameworks/#:~:text=ESG%20reporting%20frameworks%20are%20more,metrics%20for%20reporting%20each%20topic.

[8] https://www.globalreporting.org/how-to-use-the-gri-standards/gri-standards-english-language/

[9] https://gse.com.gh/wp-content/uploads/2022/11/GSE-ESG-DISCLOSURES-GUIDANCE-MANUAL-1-1.pdf

[10] Lyon T. P., Maxwell J. W. (2011). Greenwash: Corporate environmental disclosure under threat of audit. Journal of Economics & Management Strategy, 20, 3-41

[11] Dauvergne P., Lister J. (2010). The prospects and limits of eco-consumerism: Shopping our way to less deforestation? Organization & Environment, 23, 132-154, Bowen, F., & Aragon-Correa, J. A. (2014). Greenwashing in corporate environmentalism research and practice: The importance of what we say and do. Organization & Environment, 27(2), 107-112.